tennessee inheritance tax laws

The Department of Revenue is responsible for the administration of state tax laws established by the legislature and the collection of taxes and fees associated with those laws. Several years ago Tennessee repealed its state inheritance tax and as of January 1st of this year repealed its state income tax.

Also estates of nonresidents holding property in Tennessee must file an inheritance tax return INH 301.

. However it applies only to the estate physically located and transferred within the state between Tennessee residents. For Tennessee residents an estate may be subject to the Tennessee inheritance tax if the total gross estate exceeds 1250000. The inheritance tax is levied on an estate when a person passes away.

Tennessee is an inheritance tax and estate tax-free state. Final individual federal and state income tax returns. Probate is a court-supervised process that gives a family member such as a surviving spouse or.

Technically Tennessee residents dont have to pay the inheritance tax. However if the estate is undergoing probate a short form inheritance tax return INH 302 is required. Tennessee Inheritance and Gift Tax.

If the decedent left a will the probate process begins when an executor. PdfFiller allows users to edit sign fill and share all type of documents online. Ad Download Or Email TN INH 302 More Fillable Forms Register and Subscribe Now.

Within each tax type you will find the definition of the tax tax rates and due dates for returns. Franchise. Due by Tax Day of the year following.

Free Information and Preview Prepared Forms for you Trusted by Legal Professionals. There three different ways to classify property for the sake of inheritance. Each due by tax day of the year following the individuals death.

It means that even if you are a Tennessee resident but have an estate in Kentucky your heirs will be responsible for. The inheritance tax is paid out of the estate by the executor. Year Amount Exempted.

Beginning the Probate Process in Tennessee. Oil and Tire Fees. Inheritance tax is imposed on the value of the decedents estate that exceeds the exemption amount applicable to the decedents year of death.

The legislature set forth an exemption schedule for the tax with incremental increases for the exemptions until it is completely eliminated in 2016. A 360-year perpetuities period explicitly allowing special purpose entities as trust protectors. Ad Inheritance and Estate Planning Guidance With Simple Pricing.

Proving the Wills Validity. Also estates of nonresidents holding property in Tennessee must file Form INH 301. Tennessees tax exemption schedule is as follows.

Assets in excess of the federal exemption are. The federal estate tax exemption is 5450000 for 2016 and is indexed for inflation. Prior to 2016 Tennessee imposed a separate inheritance tax and had an exemption from that tax that was less than the federal estate tax exemption.

Estate And Inheritance Tax Laws When you go through probate administration its important to keep in mind the specific. Inheritance Laws in Tennessee Probate in Tennessee. If the value of the gross estate is below the exemption allowed for the year of death an inheritance tax return is not required.

States which follow common law policies dont. For nonresidents of Tennessee an estate may be subject to the Tennessee inheritance tax if it includes real estate andor tangible personal property having a situs within the state of Tennessee and the gross estate exceeds 1250000. The inheritance tax applies to money and assets after distribution to a persons heirs.

In this article we go over laws specific to Tennessee as well as ways that you can receive your inheritance cash now. However if the estate is undergoing probate a short form inheritance tax return Form INH 302 is required. Tennessee does not have an inheritance tax either.

Federal estatetrust income tax return. The net estate is the fair market value of all assets less any allowable deductions such as property passing to a surviving spouse debts and administrative expenses. The Tennessee Inheritance Tax exemption is steadily increasing to 2 million in 2014 to 5 million in 2015 and in 2016 therell be no inheritance tax.

There is a chance though that another states inheritance tax will apply if you inherit something from someone who lives in that state. The inheritance tax is different from the estate tax. What Tennessee called an inheritance tax was really a state estate tax that is a tax imposed only when the total value of an estate exceeds a certain value.

As of January 1 2016 Tennessees inheritance tax is fully repealed. This is a type of inheritance law where each spouse automatically owns half of what they each obtained while married. Year of death must file an inheritance tax return Form INH 301.

For example the neighboring state of Kentucky does have an inheritance tax. Until this estate tax is phased out the minimum tax rate for estates larger than the exemption amount is 55 and the maximum remains 95. If the value of the gross estate is below the exemption allowed for the year of death an inheritance tax return is not required.

Ad Get Access to the Largest Online Library of Legal Forms for Any State. Sales and Use Tax. Those who handle your estate following your death though do have some other tax returns to take care of such as.

Under Tennessee law the tax kicked in if your estate all the property you own at your death had a total value of more than 5 million.

When To Probate A Will In Tennessee Legalzoom Com

Pin By Graceful Aging Legal Services On Estate Planning Estate Planning Attorney Legal Services Estate Planning

Adoption In Tennessee Tn Adoption Agencies And Laws Considering Adoption

How Does An Estate Tax Marital Deduction Work Smartasset

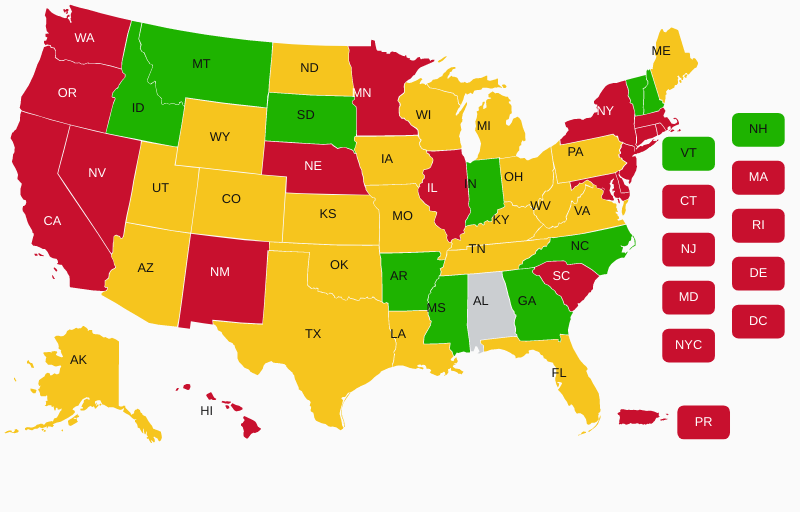

Alabama Concealed Carry Gun Laws Uscca Ccw Reciprocity Map Last Updated 03 11 2022

Alabama Concealed Carry Gun Laws Uscca Ccw Reciprocity Map Last Updated 03 11 2022

What Is Life Like In Japanese Prison English Lawyers Japan

Disabled Veterans Property Tax Exemptions By State

The Surviving Spouse Estate Tax Trap When Someone Dies Estate Tax Inheritance Tax

Alabama Concealed Carry Gun Laws Uscca Ccw Reciprocity Map Last Updated 03 11 2022

Common Mistakes People Make In Estate Planning Volunteer Law In 2022 Estate Planning Estate Planning Documents Estate Tax

/last-will-and-testament-185574992-bf59f71631d14b65a9ae4cee2e214c9f.jpg)